- Back

- PCP car finance

- HP car finance

- No deposit car finance

- Young drivers car finance

- Negative equity car finance

- Car finance with a guarantor

- Self employed car finance

- Provisional license car finance

- Instant decision car finance

- Low APR car finance

- Black box car finance

- Car finance eligibility

- Electric car finance

- Hybrid car finance

- Student car finance

- Fair credit car finance

- Key worker car finance

- Car refinancing

- FAQ

- Magazine

- News

- Glossary

- Our lenders

- Compare our lenders

- Back

- Used Alpha Romeo

- Used Audi

- Used BMW

- Used Citroen

- Used Fiat

- Used Ford

- Used Honda

- Used Hyundai

- Used Jaguar

- Used Jeep

- Used Kia

- Used Land Rover

- Used Lexus

- Used Mazda

- Used Mercedes-Benz

- Used Mini

- Used Mitsubishi

- Used Nissan

- Used Peugeot

- Used Porsche

- Used Renault

- Used Seat

- Used Skoda

- Used Suzuki

- Used Tesla

- Used Toyota

- Used Vauxhall

- Used Volkswagen

- Used Volvo

Rates from 9.9% APR: the exact rate you will be offered will be based on your circumstances, subject to status.Representative example: borrowing £7,000 over 5 years with a representative APR of 21.9%, the annual interest rate of 21.9% (Fixed) and a deposit of £0, the amount payable would be £185.33 per month, with a total cost of credit of£4,119.81 and a total amount payable of £11,119.81. We look to find the best rate from our panel of lenders and will offer you the best deal that you're eligible for. We receive a fixed fee commission per finance agreement, or we receive a commission based on a percentage of the total amount of finance taken. This will not affect the interest rate offered or the total amount repayable. Our service is free.

How car finance works

Apply & get accepted

What car you want to buy and how much you want to borrow. Once you apply for car finance, we will find you the best deal from our panel of lenders.

Apply nowPick a car from any dealer

Once accepted, choose new or used car or part exchange car from one of the reputable dealers. We will run full checks on the car for you.

Drive away the same day

Arrange a same-day car collection or delivery. Drive and enjoy!

Types of car finance options available

Personal Contract Purchase

Personal Contract Purchase (PCP) is a sort of car loan that enables you to make reasonable monthly payments throughout the contract, with an additional (optional) balloon final payment due at the conclusion.

A PCP agreement may be ideal if you want to change your vehicle every few years or are unsure if you'll want to buy it when your contract ends.

Hire Purchase

Hire Purchase (HP) is a car loan option that allows you to borrow money and spread out the expense of a new vehicle over a predetermined period by making regular monthly payments. Although your monthly payments will probably be higher than those in a Personal Contract Purchase (PCP) deal, you will ultimately own the car outright.

A HP finance agreement may be ideal for you if you plan to keep the car at the end of the term.

| Finance features: | Hire purchase (HP) | Personal contract purchase (PCP) | Personal loan |

|---|---|---|---|

| Requires initial deposit | Optional | Optional |  |

| Car is yours at the end of the agreement |  | Optional |  |

| Fixed monthly payments |  |  |  |

| Optional balloon (final) payment |  |  |  |

| Avoid excess mileage charge |  |  |  |

| Secured against an asset (e.g. a car) |  |  |  |

| Support with vehicle issues |  |  |  |

Why our customers rate us 5 stars

Compare deals

Compare and find the best car finance deals - quick and easy.

No impact to your credit

Getting a finance quote with Carplus will not affect your credit rating and you can do it for free

No deposit deals

No deposit options are available on all deals. Check if you are eligible today and get approved risk-free with soft search.

Instant quote decision

Get your UK car finance decision in minutes. Check your eligibility first. Apply in confidence with Carplus

Some of the common questions you have about car finance

What is car finance, and how does it work?

Car finance simply makes the entire process of buying a car much easier, as you won’t have to part with a lump sum of cash before you get behind the wheel. Purchasing a car on finance means getting a loan for the car, which you can then pay back in affordable, fixed monthly payments. This allows you to control your finances by making it easier to budget.

Hire purchase (HP) and personal contract purchase (PCP) are the most common forms of car finance agreements, along with guarantor and personal loans. To get car finance, you don’t need a deposit as we have no-deposit option available.

It’s important to research the different options available and make sure that you choose the best, most affordable option for your needs.

Can I get car finance if I have bad credit?

Yes, lenders will only accept you if your credit file and history are ideal. For many years, Carplus has been assisting consumers in getting on the road. We collaborate with a sizable network of lenders, some of which specialise in providing car finance even with bad credit.

Will applying for finance affect my credit score?

Carplus merely performs a soft credit check to provide you with a quote and determine your borrowing capacity. You should be wary of lenders who perform a hard credit check, though. A hard search leaves a record of your credit score.

How much can I borrow to buy a car?

Find out how much you can borrow by using our financial calculator. The exact amount you borrow will depend on your financial situation and credit score. To assist you in weighing your options, we may provide you with a free, no-obligation quote.

What do I need to apply for car finance?

In order to apply for a car loan through Carplus you must:

Depending on the lender you're approaching, you may need specific documentation to obtain car finance. However, typically, they request the following three things

SAF approved car finance specialists

Welcome to Carplus, your friendly car finance broker in the UK! We're here to help you secure car finance with ease. Our SAF approved team is committed to empowering individuals with tailored financial solutions.

Car finance calculator

| Total charge of credit | £0 |

|---|---|

| Total amount payable | £0 |

Rates from 9.9% APR: the exact rate you will be offered will be based on your circumstances, subject to status. Representative example: borrowing £7,000 over 5 years with a representative APR of 21.9%, the annual interest rate of 21.9% (Fixed) and a deposit of £0, the amount payable would be £185.33 per month, with a total cost of credit of£4,119.81 and a total amount payable of £11,119.81. We look to find the best rate from our panel of lenders and will offer you the best deal that you're eligible for. We receive a fixed fee commission per finance agreement, or we receive a commission based on a percentage of the total amount of finance taken. This will not affect the interest rate offered or the total amount repayable. Our service is free.

| Total cash price | Deposit | 60 monthly payments of | Total cost of credit | Total payable |

|---|---|---|---|---|

| £7,000 | £0.00 | £185.33 | £4,119.81 | £11,119.81 |

Why finance your next car with Carplus?

Over 15 lenders and 100 deals

With access to more than 15 lenders and over 100 car finance deals, we are more likely to find the right deal for you.

Tailored expert advice

Our expert UK car finance advisers will give you personalised advice – every step of the way. You can contact us by phone and online.

We're fast and efficient

Being online means we work quickly and efficiently, so you can keep track of your car loan application progress anywhere, anytime.

You save money

We find you the cheapest and best deal, we always look out for the car finance deal that are right for you and your budget.

We work with trusted partners

We compare car finance deals for you

Car finance guides

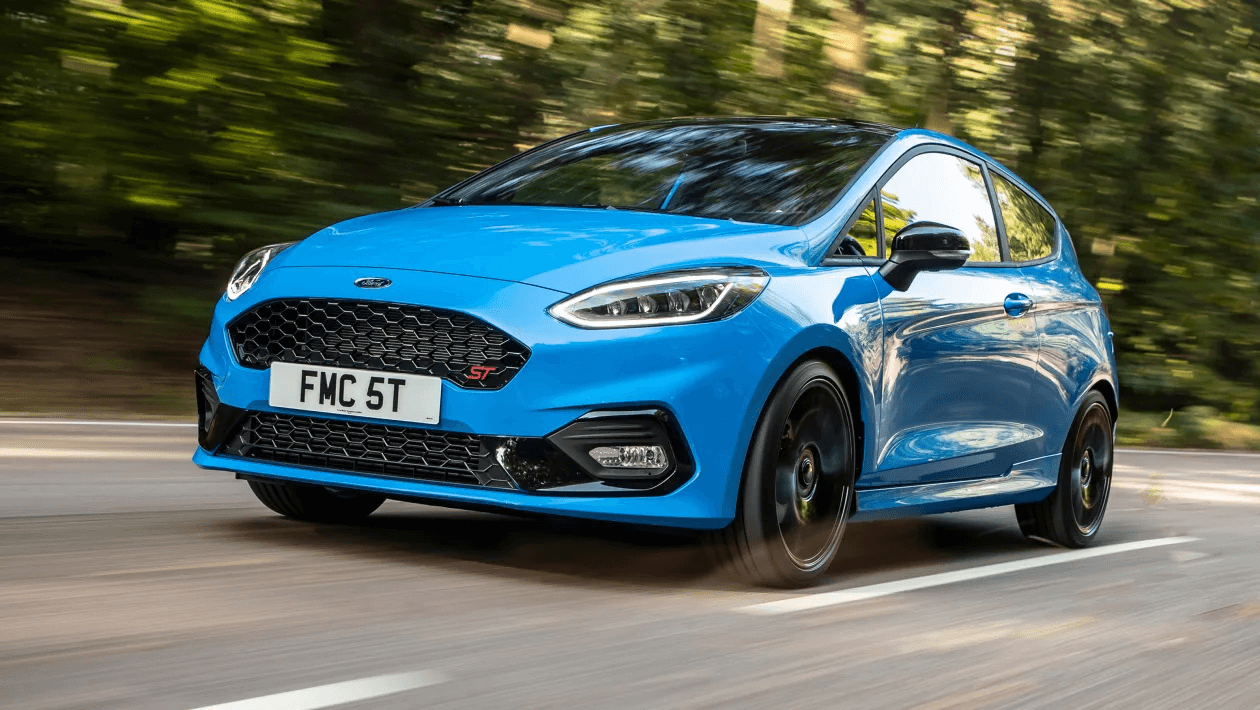

Top 12 Best Cheap Small Used Cars

Discover your perfect ride among the top-notch, cheap small used cars in the UK for 2024. Hit the road with the best without breaking the bank!

Carplus

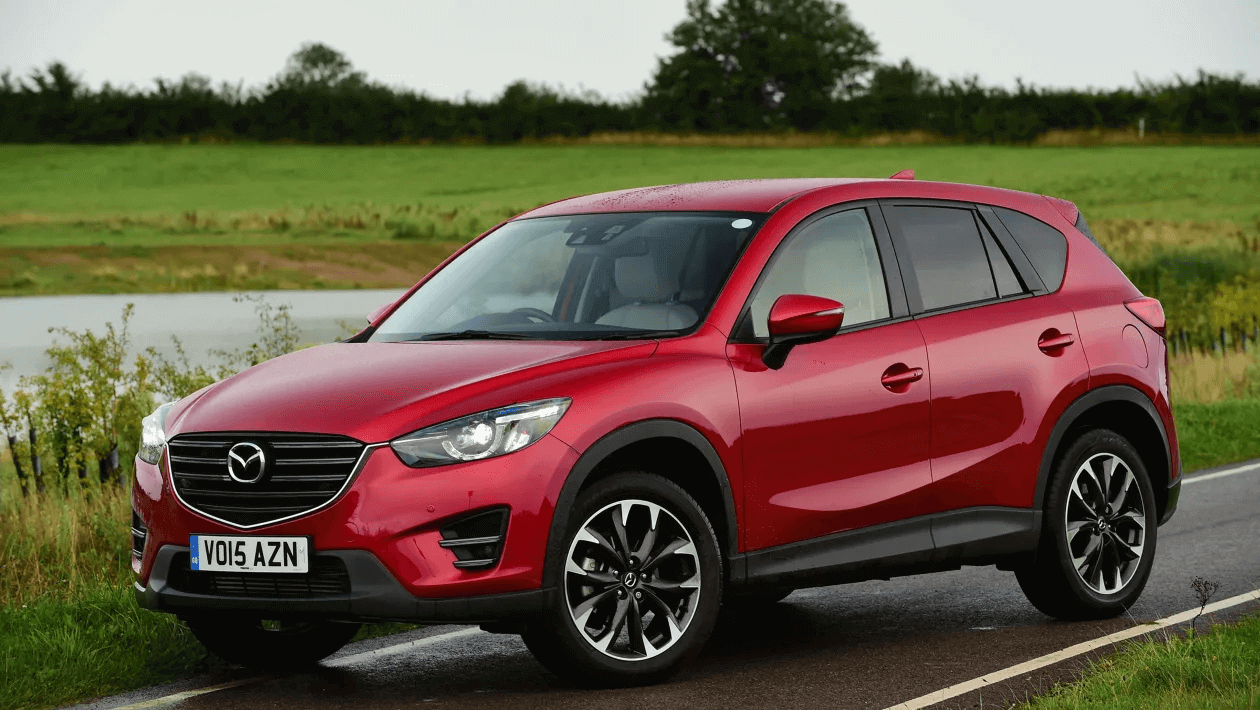

Top 11 Best Used AWD Cars

Discover the best used AWD cars in the UK. Here is a selection of reliable all-wheel-drive vehicles perfect for tackling any road conditions.

Carplus

15 Best Used Diesel Cars in the UK

For those who enjoy fuel efficiency and reliability without compromising on performance, here are the best used diesel cars in the UK.

Carplus

FAQ

Do you charge any fees?

Any fees we charge for arranging your financing with the lenders are offset by the fees we earn from them. This enables us to provide you with our services free of charge.

How long do car finance applications take?

You can fill out the form at Carplus and receive a response in just a few minutes. Your account manager will give you a call to confirm your information and go over the next steps if you've been approved in principle.

How much does car finance cost?

The cost of car finance can vary depending on several factors. This includes the type of finance option you choose, such as PCP or HP finance, as well as the interest rate, loan term, and the price of the car itself. Generally, it includes the monthly repayments, interest charges, and any additional fees or charges associated with the loan. So you have to carefully consider your monthly budget.

What is a good car finance interest rate?

A good interest rate in the UK is around 8-9% for used cars.

How long is my finance offer valid?

Your finance offer will be valid for 48 hours from the time your request for financing is approved to you paying your deposit. The vehicle you applied for will be put back up for sale on our website if your deposit isn't paid within 48 hours.

How much should your car finance deposit be?

While there are no-deposit vehicle loans available, making a substantial upfront down payment can lower the amount you need to borrow. An acceptable deposit is typically one that is at least 10% of the loan's entire amount.

Can car finance be paid off early?

Yes, car finance can typically be paid off early. However, it's essential to review the terms and conditions of your specific finance agreement, as some lenders may charge an early repayment fee.

What happens if I miss my monthly payments?

If you miss your car finance monthly repayments, it can negatively impact your credit score, and the finance company may take actions such as charging late payment fees, contacting you for payment, or, in severe cases, repossessing the vehicle.

Can you modify a car on finance?

Modifying a car on finance may be possible, but it depends on your finance agreement and the specific modifications you intend to make. It's crucial to consult with the finance company before proceeding with any modifications.

Can I give my car back to the finance company?

In certain cases, you may be able to return the car to the finance company voluntarily. This process is known as a voluntary termination, but it's subject to specific conditions outlined in your finance agreement, such as a certain percentage of the total amount being repaid. It's important to check the terms of your agreement and discuss this option with your finance provider.

What if I was already refused?

If you've been refused car loan because of bad credit, we may still be able to help. At Carplus, we work with a panel of lenders who can offer bad credit car finance.

How to use your online car finance calculator?

Simply input the amount you'd like to borrow and the time period over which you'd like to repay the loan, and then the calculator will show your monthly repayments. 🚀

What is APR?

APR stands for Annual Percentage Rate, and it is a measure of the cost of borrowing money, expressed as a percentage. It represents the total cost of the loan, including both the interest rate and any additional fees or charges. A lower APR indicates a more affordable loan, while a higher APR means you will pay more in interest over the loan term.

How can I lower monthly repayments?

To lower your monthly car finance payments, there are a few strategies you can consider. Firstly, you can opt for a longer car loan term, spreading out the payments over a greater number of months. However, keep in mind that this may result in paying more in interest over the long run. Secondly, you can increase your initial deposit or trade-in value, reducing the loan amount and subsequently lowering the monthly instalments. Finally, you can shop around and compare different lenders to find the most competitive interest rates and finance deals available, which can help decrease your monthly payment amount.