- Back

- PCP car finance

- HP car finance

- No deposit car finance

- Young drivers car finance

- Negative equity car finance

- Car finance with a guarantor

- Self employed car finance

- Provisional license car finance

- Instant decision car finance

- Low APR car finance

- Black box car finance

- Car finance eligibility

- Electric car finance

- Hybrid car finance

- Student car finance

- Fair credit car finance

- Key worker car finance

- Car refinancing

- FAQ

- Magazine

- News

- Glossary

- Our lenders

- Compare our lenders

- Back

- Used Alpha Romeo

- Used Audi

- Used BMW

- Used Citroen

- Used Fiat

- Used Ford

- Used Honda

- Used Hyundai

- Used Jaguar

- Used Jeep

- Used Kia

- Used Land Rover

- Used Lexus

- Used Mazda

- Used Mercedes-Benz

- Used Mini

- Used Mitsubishi

- Used Nissan

- Used Peugeot

- Used Porsche

- Used Renault

- Used Seat

- Used Skoda

- Used Suzuki

- Used Tesla

- Used Toyota

- Used Vauxhall

- Used Volkswagen

- Used Volvo

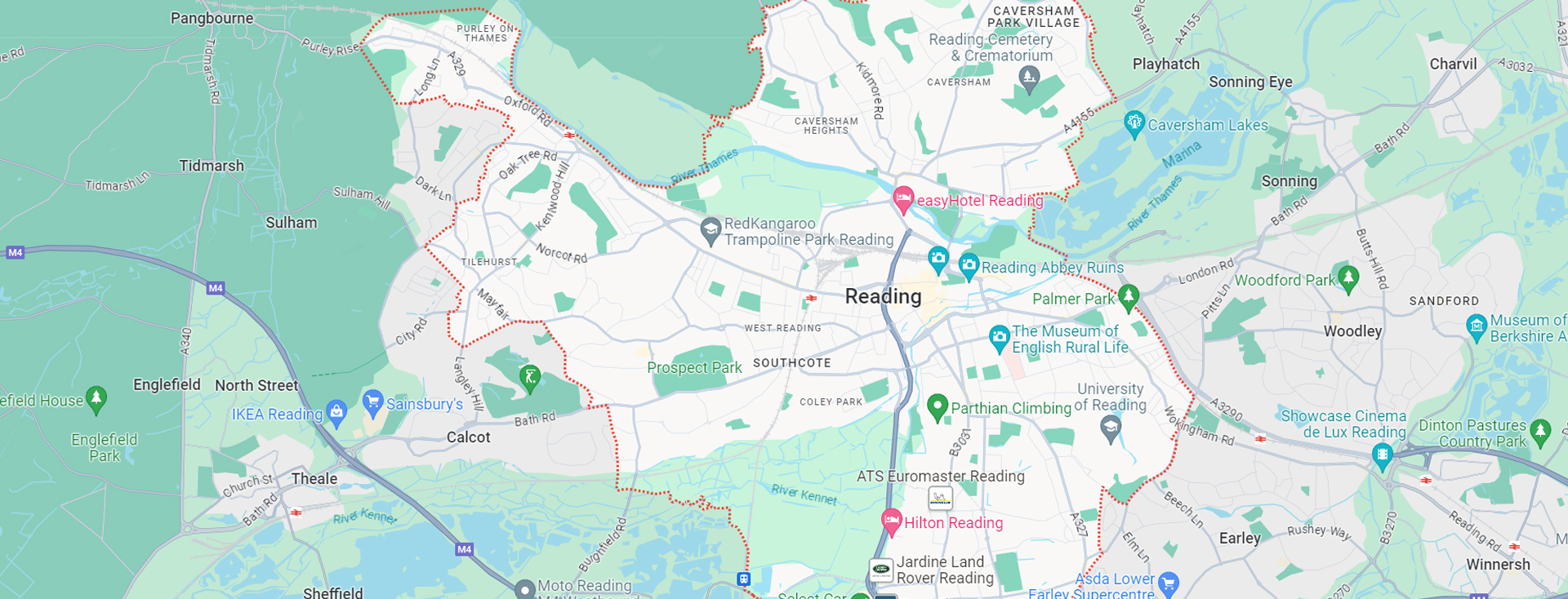

Car finance calculator - Reading

| Total charge of credit | £0 |

|---|---|

| Total amount payable | £0 |

Rates from 9.9% APR: the exact rate you will be offered will be based on your circumstances, subject to status. Representative example: borrowing £7,000 over 5 years with a representative APR of 21.9%, the annual interest rate of 21.9% (Fixed) and a deposit of £0, the amount payable would be £185.33 per month, with a total cost of credit of£4,119.81 and a total amount payable of £11,119.81. We look to find the best rate from our panel of lenders and will offer you the best deal that you're eligible for. We receive a fixed fee commission per finance agreement, or we receive a commission based on a percentage of the total amount of finance taken. This will not affect the interest rate offered or the total amount repayable. Our service is free.

At Carplus, we're your destination for car finance in Reading. We know getting the right car on finance can be life-changing. Whether you have good credit, bad credit, or no history, we've got you covered. Let's explore exciting car finance options in Reading.

Why finance your car in Reading with bad credit?

Don't let a less-than-perfect credit score hold you back from getting the car you desire. Our bad credit car finance options in Reading are tailored to help you overcome those credit bumps and hurdles. We believe that everyone deserves a second chance, and with our expertise, you can drive a quality vehicle in no time.

Is no-deposit car finance available in Reading?

Is saving up for a hefty down payment proving to be a challenge? Our Reading no deposit car finance options are here to help. You can drive away in your new car without having to pay a large sum upfront. This makes it easier for you to get behind the wheel of the car you've been eyeing.

No credit check car finance in Reading

Worried about your credit history? We've got a solution for that too. With our no credit check car finance in Reading, your past credit history won't be a roadblock. We assess your current financial situation and work towards finding a deal that suits you best. So, if you've had credit issues in the past, don't let that stop you from exploring your car finance options in Reading.

Apply for pay as you go car finance Reading

Flexibility is key when it comes to car finance. Our pay as you go car finance in Reading allows you to pay for your car as you use it. This means you can adapt your payments to your budget and lifestyle, making car ownership a hassle-free experience.

Finding a used car on finance in Reading is not a problem!

Looking for a used car on finance in Reading? You're in luck! At Carplus, we've simplified the process for you. With access to our extensive car catalogue boasting over 200,000 used cars for sale on finance, you'll be spoilt for choice. Whether you're after a compact city car, a family SUV, or something sporty, we've got it all. Plus, our affordable finance options make it easy to drive away in your dream car. So why wait? Browse our selection today and take the first step towards owning the perfect car that suits your style and budget.

What do I need for car finance in Reading?

Now that you know we've got options for everyone, you might be wondering what you need to secure car finance in Reading. It's simpler than you might think:

- Proof of Income: To ensure you can manage your car payments, we'll need to see proof of your income. This can be in the form of payslips, bank statements, or any other relevant documents.

- Residential Proof: We'll need to confirm your address, so a utility bill or a council tax statement would be ideal.

- Driving License: Naturally, you'll need a valid UK driving license to drive your new car!

- Insurance: You'll need to arrange insurance for your vehicle. We can help you with this step too.

- Details of the Car: If you've already chosen a car, having its details handy will speed up the process.

Why Choose Car Finance in Reading?

Still debating car finance in Reading? Here are great reasons to consider it:

- Affordability: Buying a car outright can be a substantial financial burden. Car finance allows you to spread the cost, making it more manageable.

- Variety: With car finance, you have access to a wide range of vehicles. You're not limited to what you can afford upfront.

- Building Credit: Making regular car finance payments can positively impact your credit score, helping you in the long run.

- Flexible Terms: Car finance offers flexible terms to suit your budget and preferences.

- No Large Upfront Payment: No need to empty your savings account for a hefty down payment; you can start driving with a minimal initial cost.

At Carplus, we're committed to accessible car finance in Reading for all. Whether you want bad credit, no deposit, or pay-as-you-go plans, we have the right solution. Contact us today for a quote and let's get you on the road!

Who can get car finance in Reading

| Unemployed |

| Self-employed |

| In part time employment |

| Zero hours contracts |

| In receipt of benefit |

| Young drivers |

| Retired drivers |

| Provisional license holders |

| Carers allowance |

| Disability allowance |

| Ex bankrupt |

| Bad credit ratings |

| No credit history |

| Military/Armed forces |

Need a hand?

We're ready to help

Choose Carplus for a seamless and customer-focused car finance experience in Reading.

Donnington Cars

37 Erleigh Rd, Reading RG1 5NB, United Kingdom

lyndelworld Cars

9A Castle Cres, Reading RG1 6AQ, United Kingdom

Legacy Dealership LTD

4 Berkeley Ave, Reading RG1 6JE, United Kingdom

Sterling Cars

132 Bath Rd, Reading RG30 2EU, United Kingdom